Encumbrance Accounting

Content

Overall, it can assist in making purchasing information more transparent and easily accessible when needed to enable tracking and overspending prevention. Encumbrance accounting, when properly implemented, allows for financial information to be seen and analyzed much quicker than a “budget to actual” accounting process. For Purchase Order and Travel Authorization encumbrances, when the vendor or employee is paid, part or all of the encumbrance is released in accordance with that payment. The department will see a transaction that will appear under their Actuals , separate from their Encumbrance (EX/IE/CE) debit/credit transactions. Lease – A lease refers to an agreement where a property is offered on rent for a given monthly price, and time period. It is considered an encumbrance as lessor doesn’t pass the title or ownership of the property to the lessee.

Encumbrances are also known as pre-expenditures since they act as budgeted reserve funds before the actual expenditure. An encumbrance system is a management tool used to reflect commitments in the accounting system for better budget management and to prevent overspending. Encumbrances allow organizations to recognize future commitments of resources prior to an actual expenditure. When a regular or standing purchase order is completed and approved in Banner, an encumbrance is automatically created.

Internal Encumbrance

With workflows optimized by technology and guided by deep domain expertise, we help encumbrance accountings grow, manage, and protect their businesses and their client’s businesses. Unencumbered refers to an asset or property that is free and clear of any encumbrances, such as creditor claims or liens. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

Tenant Estoppel Certificate — RPI Form 598 – first tuesday Journal

Tenant Estoppel Certificate — RPI Form 598.

Posted: Mon, 30 Jan 2023 08:00:00 GMT [source]

But, if the encumbrance amount has to be altered for any reason, that will either increase or decrease the appropriations account. The encumbrance is marketed in your organization’s accounts once you reserve the money. When the money is paid out, the bookkeeper zeros out the encumbrance account and reports the money as a paid expense.

What Does AFE Mean in Accounting?

The net financial burden represents the portion of the hospital’s expenses that are not covered by program revenues, directly generated by the hospital. These expenses would need to be covered by some type of general revenue and thus represent a burden to the government. Obligation – When a requisition is converted to a purchase order and the order is approved then commitment is replaced by an obligation. It is an obligation to pay the amount to the vendor against the goods and services ordered as per the purchase order terms and conditions. Asset encumbrance is the process banks go through to secure or collateralize a claim. Banks must specify assets that creditors can take possession of if the bank fails to meet its commitments. If a borrower defaults, the lender can liquidate the asset to recover their cash.

What is encumbrance in finance?

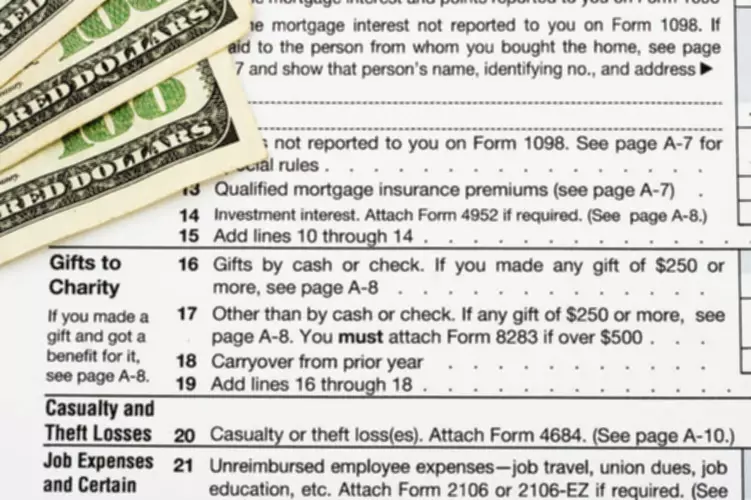

In finance, encumbrance refers to the controls accounting systems use to prevent overspending. Encumbrances determine the purpose of funds before organizations have spent any money or made a purchase.

An easement in gross enables a person to gain benefits, and not the property owner. Say, if Jennifer has got the right to use the garden of her neighbor, she cannot transfer the same right to someone who buys her property. In case of a negative easement, the owner is not allowed to build anything that causes disruptions to the neighbors property. For example, the title-holder constructing something that would interrupt the neighbors access to light. Our Purchase Orders are printed with our Terms and Conditions which form the contractual agreement of the transaction. The definition of asset encumbrance means different things to different job functions.

What Does Encumbered Mean in Accounting?

Appropriation authority – Sufficient spending appropriation authority must exist. How to capture early payment discounts and avoid late payment penalties.

For instance, a firm may set aside some amount of money as reserves for dealing with its accounts payable. The encumbrance creates a belief that the reserves account has more amounts of money than the funds actually required for use. It is important to note that such reserves are not meant to be used for paying any other expenses. Encumbrance accounting takes care of the fact that an organization spends within its budget. A purchase order encumbrance, which is recorded as 83XXXX, is increased when a purchase order is created and is decreased or reversed when an invoice is matched to the purchase order.

Example Question #4 : Encumbrance Accounting

It is imhttps://www.bookstime.com/rtant, from the buyer’s perspective, to be aware of any encumbrances on a property, since these will often transfer to them along with ownership of the property. An easement refers to a party’s right to use or improve portions of another party’s property, or to prevent the owner from using or improving the property in certain ways. For example, a utility company may have the right to run a gas line through a person’s property, or pedestrians might have the right to use a footpath passing through that property. Anderson is CPA, doctor of accounting, and an accounting and finance professor who has been working in the accounting and finance industries for more than 20 years. Her expertise covers a wide range of accounting, corporate finance, taxes, lending, and personal finance areas. GASB has been working for some years to establish a standard for measurement and financial reporting of “other post-employment benefits” .

- Lien – A lien is referred to as an interest on security, that is seen as an encumbrance having an impact on the ownership of the property.

- An encumbrance refers to a claim that a neighboring property owner makes against the one who owns the property.

- This encumbrance is later converted to expenditures when goods or services are subsequently procured.

- Other encumbrances, such aszoning lawsand environmental regulations, do not affect a property’s marketability but do prohibit specific uses for and improvements to the land.

- An encumbrance is a claim made against a property by someone other than the current titleholder.

مدیریت سایت

مدیریت سایت